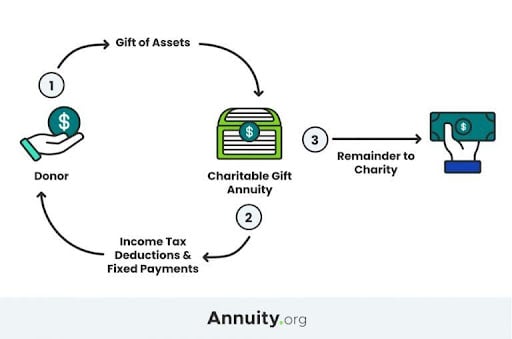

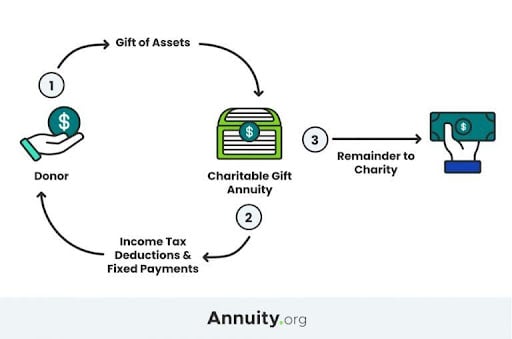

A charitable gift annuity is an agreement between a donor and a charitable organization in which the donor makes a donation, and in return the charitable organization provides them with a regular stream of payments for life.

Brandon Renfro, Ph.D., CFP®, RICP®, EA Co-Owner of Belonging Wealth Management As a Certified Financial Planner™ professional and Retired Income Certified Professional®, Brandon Renfro is well-versed in the financial information and strategies needed to meet retirement goals. In addition to co-owning Belonging Wealth Management and assisting clients, Brandon writes regularly for financial publications. Read More

Michael Santiago, CRPC™ Senior Financial Editor Michael Santiago is a skilled writer and editor with over a decade of experience in various industries. As a senior financial editor, he collaborates with a team of experts to develop compelling and accurate content. Read More

Chip Stapleton FINRA Series 7 and Series 66 License Holder Chip Stapleton is a financial advisor who has spent the past several years of his career working primarily in financial planning and wealth management. He is a FINRA Series 7 and Series 66 license holder and passed the CFA Level II exam in 2022. Read More

Fact Checked Fact CheckedAnnuity.org partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

How to Cite Annuity.org's ArticleAPA Annuity.org (2024, August 8). Charitable Gift Annuity. Retrieved September 18, 2024, from https://www.annuity.org/annuities/types/charitable-gift/

MLA "Charitable Gift Annuity." Annuity.org, 8 Aug 2024, https://www.annuity.org/annuities/types/charitable-gift/.

Chicago Annuity.org. "Charitable Gift Annuity." Last modified August 8, 2024. https://www.annuity.org/annuities/types/charitable-gift/.

Why Trust Annuity.org Why You Can Trust Annuity.orgAnnuity.org has provided reliable, accurate financial information to consumers since 2013. We adhere to ethical journalism practices, including presenting honest, unbiased information that follows Associated Press style guidelines and reporting facts from reliable, attributed sources. Our objective is to deliver the most comprehensive explanation of annuities and financial literacy topics using plain, straightforward language.

We pride ourselves on partnering with professionals like those from Senior Market Sales (SMS) — a market leader with over 30 years of experience in the insurance industry — who offer personalized retirement solutions for consumers across the country. Our relationships with partners including SMS and Insuractive, the company’s consumer-facing branch, allow us to facilitate the sale of annuities and other retirement-oriented financial products to consumers who are looking to purchase safe and reliable solutions to fill gaps in their retirement income. We are compensated when we produce legitimate inquiries, and that compensation helps make Annuity.org an even stronger resource for our audience. We may also, at times, sell lead data to partners in our network in order to best connect consumers to the information they request. Readers are in no way obligated to use our partners’ services to access the free resources on Annuity.org.

Annuity.org carefully selects partners who share a common goal of educating consumers and helping them select the most appropriate product for their unique financial and lifestyle goals. Our network of advisors will never recommend products that are not right for the consumer, nor will Annuity.org. Additionally, Annuity.org operates independently of its partners and has complete editorial control over the information we publish.

Our vision is to provide users with the highest quality information possible about their financial options and empower them to make informed decisions based on their unique needs.

Charities and donors can both benefit from using a form of planned giving called a charitable gift annuity. Charitable gift annuities are similar to other annuities in that a lump sum is exchanged in return for a series of payments.

However, instead of involving an insurance company, there is a contractual agreement between the donor and nonprofit that manages the charitable gift annuity. The funds are invested, and while the donor is living they receive payments from the charitable organization where they established the charitable gift annuity. Upon their death, their chosen charity receives the remaining annuity balance.

There are some potential advantages to charitable gift annuities over a more traditional donation.

Gift annuities are one form of planned giving (a way donors can give major gifts such as cash, property or assets to nonprofits and charities).

Other forms of planned giving are:

Chip Stapleton FINRA Series 7 and Series 66 License HolderCGAs could be very beneficial to closely held businesses owners. Generally, the owners have significant capital appreciation in their business, and selling could create a sizable capital gain.

Chip Stapleton is a financial advisor who has spent the past several years of his career working primarily in financial planning and wealth management. He is a FINRA Series 7 and Series 66 license holder and passed the CFA Level II exam in 2022.

Religious, charitable and educational organizations are all 501(c)(3) organizations that can use CGAs. While not all nonprofit charities accept these gifts, many do.

The Internal Revenue Service defines 501(c)(3) organizations as groups that are “charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition and preventing cruelty to children or animals.” By the same definition, 501(c)(3) organizations cannot exist for the primary benefit of private shareholders. To comply with the tax code, charities send CGA annuitants IRS Form 1099-R and designate which contributions (whether cash or property) are taxable, nontaxable or capital gain.